The Performing Artist Tax Parity Act (PATPA), aimed at restoring tax fairness for entertainment professionals, has been reintroduced in Congress. The legislation was brought back to the House chamber on April 19 by Representatives Vern Buchanan (R-FL) and Judy Chu (D-CA), who first introduced the bipartisan bill in July 2021.

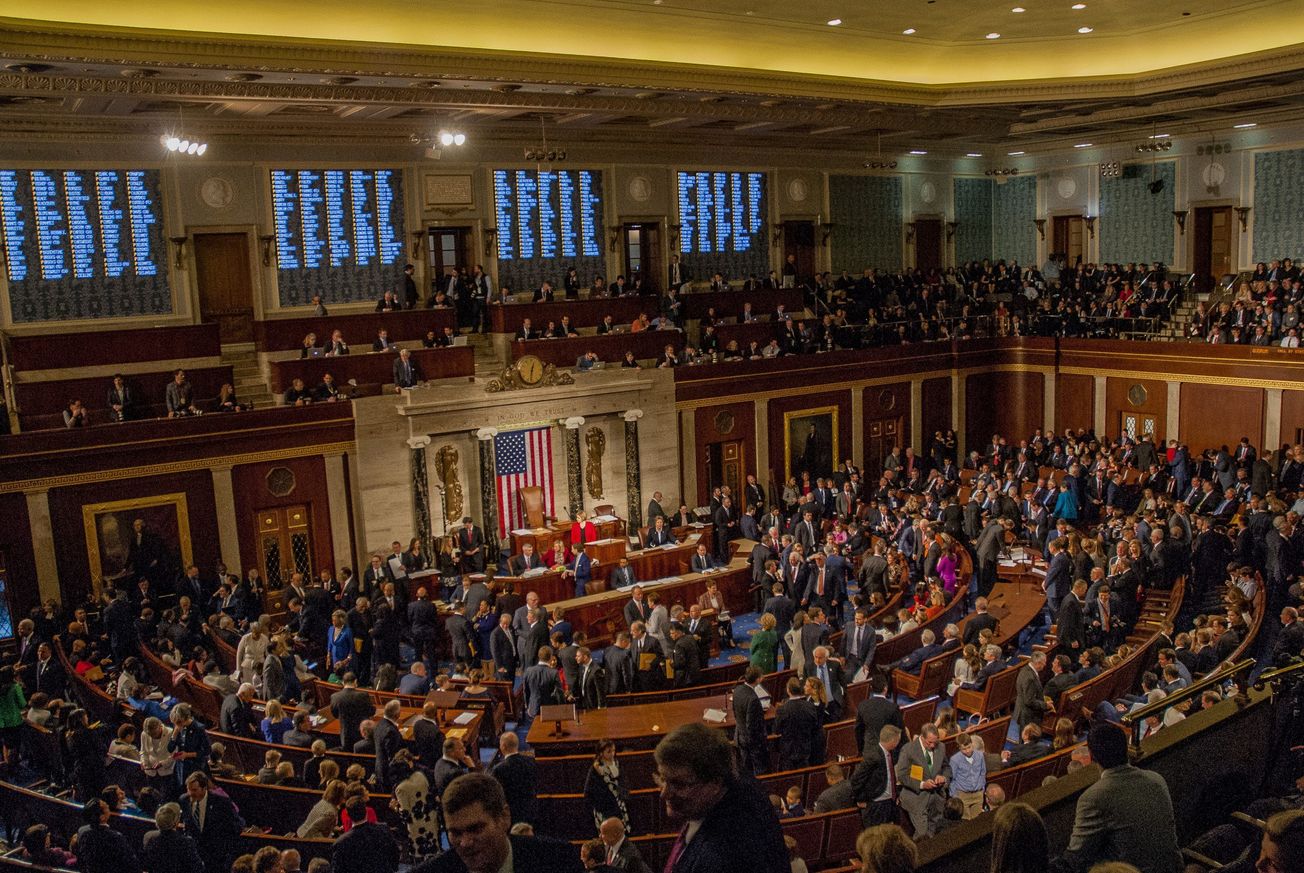

Now, PATPA will be assigned to a committee, whose members will research and review the bill. The committee will make any changes they deem necessary before putting PATPA forward for a vote in the House of Representatives.

If the vote passes there, the Senate will then go through a similar process to review the bill before voting. If the bill gains enough votes in each body of Congress, the House and Senate then have to reconcile any differences between the two passed versions of PATPA before the entirety of Congress takes a final vote. If that vote passes, PATPA moves on to President Biden for review; he will either veto the bill or sign it into law.

The bill, if passed, would update the Qualified Performing Artist (QPA) deduction. This would allow more performing artists to deduct essential work expenses from their taxes. Currently, the QPA enables eligible arts workers to take an “above-the-line” deduction for certain unreimbursed expenses. However, only those with an adjusted gross income of $16,000 are eligible. PATPA would raise that amount to $100,000 for individual filers and $200,000 for couples.

Experts estimate that arts workers spend between 20 and 30 percent of their income on necessary work-related expenses, including headshots and management fees. If passed, PATPA would allow workers to claim these expenses on their taxes.

In December, Actors Equity Association appealed to its members to call upon their representatives to pass PATPA. The Department for Professional Employees, AFL-CIO (DPE) — a coalition of 24 unions that represents more than four million union members — has applauded the bill’s reintroduction as has Actors’ Equity Association.

President of Equity Kate Shindle said, “Thousands of Equity members just filed their taxes, and again owed hundreds — sometimes thousands — of dollars more than before. The overwhelming majority of arts professionals are middle-class workers who just can’t afford that. Fortunately, the tax code already recognizes the up-front business expenses of working in our industry; the problem is simply that the relevant income thresholds haven’t been revised since the Reagan Administration. We are grateful for the leadership of Reps. Buchanan and Chu, and thank them for reintroducing this critical bipartisan legislation while we’re all still working toward a full recovery of the live performing arts.”